Resources

Welcome to our knowledge base of research that demonstrates our understanding of complex business challenges faced by companies around the world.

On 26 October 2025, Malaysia and the US signed the Agreement on Reciprocal Trade (ART) during the 47th ASEAN Summit in Kuala Lumpur. Under Executive Order 14257 issued by the US President on 2 April 2025, the agreement is a US proposal to renegotiate tariffs on Malaysia from 25 percent to 19 percent.

The agreement covers many areas including among others in relation to Good Regulatory Practices (GRP). This update will only focus on Good Regulatory Practices (GRP), and it is beyond the scope of this update to discuss the ART as a whole.

Good Regulatory Practices (GRP)

Article 2.8 in relation to Good Regulatory Practices (GRP) specifically states that:

Malaysia shall adopt and implement good regulatory practices as set out in Article 2.21 of Annex III that ensure greater transparency, predictability, and participation throughout the regulatory lifecycle.

Under Annex III: Specific Commitments, Article 2.21 in relation to Adoption and Implementation of Good Regulatory Practices (GRP) sets out the following:

With respect to the adoption and implementation of good regulatory practices at the central level of government, Malaysia shall─

(a) ensure that laws, regulations, procedures, and administrative rulings are promptly published and made easily accessible online;

(b) under normal circumstances,[1] publish and make easily accessible online the text of proposed regulatory measures,[2] as well as any regulatory impact analysis, an explanation of the regulation, and its objective;

(c) conduct public consultations for proposed regulatory measures in a transparent manner; allow adequate time for interested persons, domestic and foreign, to submit comments, taking into account the complexity or possible impact of the proposed regulation; and give consideration to comments received;

(d) give reasonable notice of planned regulatory measures and publish regulatory policy priorities that will be developed, modified, or eliminated in the near term;

(e) use publicly accessible high-quality data, evidence, technical information, and risk assessments, where appropriate, during the planning and development of regulation;

(f) support international regulatory cooperation through the use of, as appropriate, relevant international standards, guides, and recommendations to avoid unnecessary obstacles to trade;

(g) conduct reviews of regulation in effect to determine whether new information or other changes justify modification or repeal of regulation; and use tools, such as regulatory impact analysis, to assess the need for and possible impacts of regulations, which could also include alternative approaches to regulation, where appropriate.

Key observations on the Good Regulatory Practice (GRP) requirements

- The requirement operates ‘one way’ for Malaysia as it only requires Malaysia to comply, perhaps on the assumption that the US has already complied with such Good Regulatory Practice (GRP) requirements in its domestic legal framework.

- The requirement is only imposed at the ‘central government’ level which is interpreted as Federal Government level and thus, is an important consideration given the autonomy of States and Local Governments to legislate on their own.

- The requirements from (a) to (g) Annex III: Specific Commitments, Article 2.21 already are reflective in our National Policy on Good Regulatory Practice (NPGRP). The author does not intend to cover this exhaustively, but these requirements can be seen for example in our Regulatory Process Management System (RPMS) framework, adoption of evidence-based tools such as Regulatory Impact Analysis (RIA) and Behavioral Insights (BI), and specific elements there under such as the consultation process and option development.

According to the Attorney General’s Chambers (AGC), ART will only come into effect 60 days after both parties exchange written notifications confirming that their domestic legal procedures have been completed. It is thus unclear when this will specifically occur given the range of matters agreed in the ART that would require domestic policy to be revisited.

Notwithstanding this, it is the author’s view that signing the bilateral reciprocal trade agreements would have the impact of requiring parties to upgrade domestic requirements in line with international standards, particularly on Good Regulatory Practices (GRP).[3] Malaysia is no stranger to this where it ratified the multilateral Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) on 30 September 2022 which also included Good Regulatory Practices (GRP) requirements in Chapter 25: Regulatory Coherence.

It is also the author’s view that from a domestic perspective on Good Regulatory Practices (GRP), it can be perceived that our domestic Good Regulatory Practices (GRP) ecosystem is already in line with best practice. In line with ASEAN’s Vision 2045 call to action to ‘embed’ GRP in every workstream, such requirements have already seamlessly been integrated into the domestic policy and regulatory development cycle. It is then with optimism that we look forward to the next transformation of our National Policy on Good Regulatory Practice(NPGRP) that will set the benchmark of our Good Regulatory Practices (GRP)ecosystem for years to come.

The Agreement can be accessed here https://www.miti.gov.my/ART.

If you have any questions or require any additional information, please contact our Partner and Head of the Government Advisory Practice, Mohamad Izahar Mohamad Izham at izaharizham@ziclegal.com of Zaid Ibrahim & Co.

This alert is for general information only and is not a substitute for legal advice.

[1] “normal circumstances” do not include, for example, situations in which: publication in accordance with subparagraph (b) would render the regulatory measure ineffective in addressing the particular harm to the public interest that the regulatory measure aims to address; urgent problems (for example, of safety, health, or environmental protection) arise or threaten to arise for Malaysia; or the regulatory measure has no substantive impact upon members of the public, including persons of the United States.

[2] “regulatory measures” means measures of general application adopted, issued, or maintained by a regulatory authority with which compliance is mandatory, except: general statements of policy or guidance that do not prescribe legally enforceable requirements or measures concerning: (i) military, foreign affairs, or national security functions of the Government; (ii) public sector management, including personnel, pensions, public property, loans, grants, benefits, or contracts;(iii) departmental organization, procedure, or practice; or (iv) taxation, financial services, anti-money laundering, monetary policy, exchange rate policy, or government procurement. For greater certainty, a regulatory authority at the central level of government does not include legislatures or courts.

[3] At the time of writing, it is understood that the only two ASEAN countries that have signed the bilateral reciprocal trade agreements with the US is Cambodia and Malaysia.

Agreement between the United States of America and Malaysia on Reciprocal Trade (ART), and Good Regulatory Practices (GRP)

On 3 October 2025, with robust governmental support and momentum, the Ministry of Finance has successfully gazetted the order and the rules in relation to Pulau 1 of Forest City Special Financial Zone (“Single Family Office Order and Rules”).

While wealthy families have historically chosen specific established tax exempted jurisdictions to establish their generational wealth management family office structures, Malaysia is now well-positioned to compete with these jurisdictions in attracting family office establishments by having specific tax incentives and stamp duty exemptions to attract both Malaysian and foreign families to establish their family offices within the Forest City Special Financial Zone.

To date, 6 families have received conditional approval from the Securities Commission (“SC”), with indicative assets under management (“AUM”) of close to RM400 million.

Single Family Office Incentive Scheme (“Scheme”)

Families intending to set up their family office under this Scheme must establish 2 Malaysian incorporated companies - the Single Family Office Vehicle (“SFOV”) and the Single Family Office Management Company(“SFO MC”). Both the SFOV and the SFO MC must be wholly owned, directly or indirectly, by one or more individuals, all of whom should be members of a single family. “Single Family” means a family whose members are individuals who are lineal descendants of a single ancestor and includes:

(a) the spouse;

(b) the biological child;

(c) the stepchild; and

(d) the child adopted in accordance with any written law.

The SFOV is solely for the purpose of holding the assets and investments of the single family, while the SFO MC is for the purpose of managing such assets and investments. The SFO MC is not required to be operating in Pulau 1.

SFOV

A qualifying company may apply for the Scheme to the Minister through the SC from 1 September 2024 to 31 December 2034.

A “qualifying company” is a single family fund company which [1]:

(a) is incorporated under the Companies Act 2016 and resident in Malaysia;

(b) is wholly owned, directly or indirectly, by a member of a single family;

(c) operates in Pulau 1 of Forest City Special Financial Zone; and

(d) is established solely for the purpose of holding the asset and investment activity for the interest of

members of a single family.

A “qualifying company” will not be regarded as a qualifying company for the purposes of the Scheme if, it has claimed or been granted other tax incentives under Malaysian law. Specifically, the company will be disqualified if [2]:

(a) a claim has been made for investment allowance for the service sector under Schedule 7B to the Income

Tax Act 1967;

(b) any incentive has been granted under the Promotion of Investments Act 1986;

(c) an exemption has been granted under paragraph 127(3)(b) or subsection 127(3A) of the Income Tax Act

1967;

(d) an incentive scheme has been approved by the Minister under any rules made pursuant to section 154 of

the Income Tax Act 1967;or

(e) a claim has been made for deduction under any rules made under section 154 of the Income Tax Act 1967,

except for:

(i) allowances under Schedule 3 to the Income Tax Act 1967;

(ii) deductions under the Income Tax (Deduction for Audit Expenditure) Rules 2006; or

(iii) deductions under the Income Tax (Deduction for Expenses in relation to Secretarial Fee and Tax

Filing Fee) Rules 2020.

Upon obtaining SC’s approval for the tax incentives granted pursuant to the Scheme, an approved company shall comply with the conditions imposed by the Minister which shall include the following conditions [3]:

(a) for each year for the first period of 10 years of assessment, the approved company shall obtain a

certification from SC that the approved company:

(i) has employed at least 2 full-time employees whom one of the employees is a professional

investor with a minimum salary of RM10,000;

(ii) has not utilised bank deposits for local investment;

(iii) at the end of the year of assessment—

(A) has incurred an annual local operating expenditure of not less than RM500,000;

(B) has assets under its management of not less than RM30 million; and

(C) in relation to a local investment, has made an investment of not less than RM10 million or

10% of the assets under its management referred to in subparagraph(a)(iii)(B), whichever is

the lower; and

(iv) has not carried on any other business in Malaysia;

(b) for each year for the following period of 10years of assessment, the approved company shall obtain a

certification from the SC that the approved company at the end of the year of assessment:

(i) has assets under its management of not less than RM50 million;

(ii) in relation to a local investment, has made an investment of not less than RM10 million or

10% of the assets under its management referred to in subparagraph (b)(i), whichever is greater;

(iii) has employed at least 4 full-time employees; and

(iv) has incurred an annual local operating expenditure of not less than RM650,000.

(c) the approved company shall comply with the conditions provided for under section 65B of the Income

Tax Act 1967; and

(d) the approved company shall comply with any guidelines issued by the SC.

Tax incentives under the Forest City Special Financial Zone framework

Pulau 1 was designated as a duty-free island and officially recognised as a “Designated Area” under Malaysia’s Sales Tax and Services Tax regimes, with similar duty-free status as Langkawi, Labuan, and Pangkor.

Effective 1 September 2024, the tax incentives for the SFOV include:

(a) 0% income tax rate for the first period of 10 years of assessment and 0% income tax rate the following

period of 10 years of assessment by the approved company.[4]

(b) Full exemption on gains from share disposal from 1 September 2024 to 31 December 2034, subject to

further conditions.[5]

(c) Full exemption on income received from any qualifying persons for income received on or before 31

August 2034, subject to conditions.[6]

(d) 10% of industrial building allowance on the capital expenditure for the construction or purchase of an

industrial building for Year of Assessment 2024 onwards until 31 December 2034, subject to conditions.[7]

(e) Deduction up to RM500,000 maximum for certified relocation costs, subject to conditions.[8]

Stamp Duty exemptions under the Forest City Special Financial Zone framework

Apart from tax incentives, transactions and transfers of a qualifying asset executed from 1 September 2024 to 31 December 2034 may qualify for a range of stamp duty exemptions introduced by the Government to encourage investment and the establishment of family offices in the area.

The key stamp duty exemptions are:

(a) Exemption of stamp duty for transfers of qualifying assets between single family fund companies and

their related family entities.[9]

(b) 50% remission on loan or financing agreements for eligible individuals[10] and qualifying investors[11]

purchasing completed residential or commercial units in Pulau 1.

(c) 50% remission on property transfer instruments for eligible individuals[12] and qualifying investors[13]

purchasing completed residential or commercial units in Pulau 1.

Real Property Gains Tax (“RPGT”) exemptions under the Forest City Special Financial Zone framework

RPGT, a tax imposed on profits arising from the disposal of real property in Malaysia, now offers progressive exemptions for non-citizen and non-permanent resident individuals disposing of property within Pulau 1 of Forest City Special Financial Zone. Effective from 1 September 2024 to 31 July 2034, the Scheme provides for progressive reductions in RPGT rates during the initial years of ownership, culminating in a full exemption after the sixth year, to promote long-term property investment in Pulau 1.[14]

The introduction of the newly implemented Single Family Office Order and Rules marks a significant milestone in Malaysia’s efforts to position itself as a regional hub for wealth management and family office activities. The comprehensive incentives framework under the Forest City Special Financial Zone reflects the Government’s continued commitment to ensuring the success of the Scheme, as evidenced by the growing number of family office applications currently being reviewed by the SC.

Please feel free to reach out to the contributing partners and associates to this alert – Chua Wei Min, Lee Lily @ Lee Eng Cher, Sarah Menon and Coe Tay for further information.

[1] Income Tax (Single Family Office Incentive Scheme) (Pulau 1 of Forest City Special Financial Zone)Rules 2025

[2] Income Tax (Single Family Office Incentive Scheme) (Pulau 1 of Forest City Special Financial Zone)Rules 2025

[3] Income Tax (SingleFamily Office Incentive Scheme) (Pulau 1 of Forest City Special Financial Zone)Rules 2025

[4] Income Tax (Single Family Office Incentive Scheme) (Pulau 1 of Forest City Special Financial Zone)Rules 2025

[5] Income Tax (Single Family Office Incentive Scheme) (Pulau 1 of Forest City Special Financial Zone) (Exemption) Order 2025

[6] Income Tax (Income of Non-Resident Person) (Pulau 1 of Forest City Special Financial Zone)(Exemption) Order 2025

[7] Income Tax (Industrial Building Allowance) (Pulau 1 of Forest City Special Financial Zone) Rules 2025

[8] Income Tax (Deduction of Cost for Relocation of Business) (Pulau 1 of Forest City Special Financial Zone) Rules 2025

[9] Stamp Duty (Single Family Fund Company) (Pulau 1 of Forest City Special Financial Zone)(Exemption) Order 2025

[10] Stamp Duty (Instrument of Loan or Financing Agreement in relation to Individual) (Pulau 1 of Forest City Special Financial Zone) (Remission) Order 2025

[11] Stamp Duty (Instrument of Loan or Financing in relation to Qualifying Person) (Pulau 1 of Forest City Special Financial Zone) (Remission) Order 2025

[12] Stamp Duty (Instrument of Transfer in relation to Individual) (Pulau 1 of Forest City Special Financial Zone)(Remission) Order 2025

[13] Stamp Duty (Instrument of Transfer in relation to Qualifying Person) (Pulau 1 of Forest City Special Financial Zone)(Remission) Order 2025

[14] Real Property Gains Tax (Pulau 1 of Forest City Special Financial Zone) (Exemption) Order 2025

Single Family Offices in the Forest City Special Financial Zone and New Incentive Frameworks

The Budget 2026, announced on 10 October 2025, highlights significant reforms in Malaysia’s tax administration aimed at enhancing compliance and efficiency. Key measures include the nationwide implementation of the e-invoicing initiative in 2026 and the introduction of a stamp duty self-assessment system to promote greater taxpayer compliance.

In addition, the government aims to expedite the refund process for overpaid taxes within the next year. The long-anticipated Carbon Tax is also set to be introduced in 2026, with an initial focus on the iron, steel, and energy sectors.

Beyond these new developments, the government continues to propose new incentives and exemptions, as well as extensions of existing ones, to support the nation’s economic growth.

This alert highlights the key updates from Budget 2026 for taxpayers to stay informed of the forthcoming changes to Malaysia’s tax laws and administrative policies.

Corporate Tax

There were several key announcements from a corporate tax perspective during the Budget 2026 and this includes, among others, accelerated capital allowance (ACA), green technology investment, and incentives for venture capital companies and companies in the tourism sector. It was proposed, amongst others, that:

- Capital Expenditure for ICT – companies can claim ACA on capital expenditure for plant, machinery and information and communication technology (ICT) equipment. The initial allowance of 20% and 40% annual allowance under ACA are intended for qualifying capital expenditure incurred from 11 October 2025 to 31 December 2026.

- Tourism Industry – tax deduction of up to RM500,000 on capital expenditure for project operators registered with the Ministry of Tourism, Arts and Culture, undertaking tourism projects involving renovation and refurbishment of business premises. In relation to tourism and cultural sectors, tourism operators are proposed to be given a 100% income tax exemption on the value of increased income incremental from tour packages to Malaysia.

- Venture Capitalist – improvement of the existing venture capital tax incentives which may be granted for up to 10 years, a special corporate tax rate of 5% and dividend tax exemption for individual shareholders.

- Green Tech – 100% Green Investment Tax Allowance (GITA) for companies that use green technology products in their local supply chains, as certified by MyHIJAU Mark. The Green Technology Financing Scheme (GTFS) 5.0 offers a government guarantee incentive of up to 80% for green technology in the waste sector and up to 60% for other sectors such as energy, water, transportation and manufacturing.

- Food waste – Companies engaging in new food production activities are proposed to be given a 100% income tax exemption on statutory income, for a period of 10 years, meanwhile existing companies undertaking food expansion projects are given a 100% income tax exemption on statutory income, for 5 years.

- AI Tech – a tax incentive was proposed for training in Artificial Intelligence (AI) whereby a deduction of 50% to be given to Micro, Small and Medium Enterprises (MSME) on expenses incurred for AI training.

- Real Estate – For renovation and conversion of commercial buildings into residential units, it was proposed a special tax deduction of 10% to be granted. This deduction is capped at RM10 million.

Stamp Duty

Whilst in preparation of the self-assessment system for stamp duty, taxpayers should also keep in mind announcement made by Budget 2026 which includes the increase of stamp duty rate for transfer of residential property, change in threshold for the stamp duty exemption on employment contracts, and extensions to stamp duty exemptions. It was proposed, amongst others, that:

- The flat rate of stamp duty for instruments of transfer of residential property to non-citizen individuals (other than permanent residents) and foreign companies was proposed to increase to 8%, which will be applicable to instruments effecting the transfer of residential property executed from 1 January 2026 onwards.

- Exemption for employment contract below RM3,000 executed 1 January 2026 onwards.

- Exemption for instruments of transfer and loan agreements for the purchase of a first home valued up to RM500,000 will be extended until 31 December 2027.

- Exemption for insurance policies or takaful certificates for the products of “Perlindungan Tenang” will be extended until 31 December 2028.

- Exemption for insurance policies or small-value takaful certificates purchased by individuals and MSMEs is extended until 31 December 2028.

Indirect Tax

The Royal Malaysian Customs Department (RMCD) in focusing on strengthening tax compliance and aiming to reform its tax administration for sales and service tax (SST), import duty and excise duty has also made some key announcement, amongst others:

- The RMCD is focusing on enhancing its enforcement, and this includes the introduction of digital tax stamps with advanced security features to prevent counterfeiting and leakage during imports. This is supported by the Centralised Screening Complex (CSC) CCTV system to strengthen surveillance at key entry points.

- As an initiative to strengthen the Agenda Nasional Malaysia Sihat, the increase of excise duty on cigarettes, cigars, cheroots, cigarillos and heated tobacco products starting 1 November 2025 where the increase will be in phases. Additionally, the excise duty on alcoholic beverages will also be increased by 10%, starting 1 November 2025. The exemptions on import duty and sales tax for Nicotine Replacement Therapy products will be extended until 31 December 2027, which includes products such as nicotine gum and patches, and will further expand to include nicotine mist and lozenges.

- Starting 1 January 2026, import duty, sales tax and excise duty will be imposed on vehicles imported into Langkawi or Labuan with values exceeding RM300,000. Meanwhile, full excise duty and sales tax exemptions will continue for eligible taxi and private hire vehicle owners for purchase of new Proton and Perodua vehicles.

Following the recent expansion of SST scopes earlier in June and July of this year, there was no significant changes to the SST regime announced during the Budget 2026.However, we may anticipate other initiatives by the RMCD moving forward to improve compliance and reform its administration whether through new policies or legislative amendments.

Individual Tax

Other than the updates on taxes and duties affecting the corporations and businesses, the Budget 2026 also proposed a plethora of individual tax reliefs and incentives, which include the following:

- The expansion in the scope of relief for life insurance / takaful announced in the Budget 2026 includes an income tax relief of RM3,000, expanded to cover payments of life insurance premiums / takaful contributions on policies contracted for the lives of one’s children.

- Income tax relief on expenses for vaccination by individual be expanded to cover all types of vaccines registered and approved by the Ministry of Health.

- In effort to encourage Malaysian to tour within the country in view of the “Tahun Melawat Malaysia 2026”, the government proposed a special income tax relief for individuals of up to RM1,000 for entrance fees to local tourist attractions and cultural programmes.

- Income tax relief of RM3,000 to be expanded to include daily care centres or after-school transit centres for children aged up to 12 years old.

This alert serves as a quick reference to the key highlights from Budget 2026, focusing primarily on tax and duty measures. The Budget 2026 speech contains further details, including matters not covered in this alert. In the event of any discrepancy, the Budget speech shall prevail. Please note that the proposals have not yet been gazetted and remain subject to legislative changes.

Budget 2026 Highlights – Updates on Tax and Duties

Following last week’s overview of Malaysia’s CCUS Act 2025, our second article in the CCUS Series turns the spotlight on the CCUS (Offshore Permit and Licensing) Regulations 2025, which governs the permanent storage of CO2 in offshore areas.

Leveraging their in-depth understanding of Malaysia’s CCUS legal framework, Khoo Yu Lin and Cheng Yen of Zaid Ibrahim & Co. guide readers through and provide unique insights on:

- the lifecycle of offshore storage projects;

- key obligations of offshore operators; and

- import permit requirements for CO₂ captured outside Malaysia.

Overview of the Regulations on the Offshore Storage of Carbon Dioxide

With the Carbon Capture, Utilization and Storage Act 2025 and its accompanying Offshore Regulations coming into force, Malaysia takes a decisive step in its energy transition journey. As the country moves toward its net-zero emissions target by 2050, understanding the legal landscape surrounding CCUS is essential for stakeholders entering this emerging sector.

In this first article of the CCUS series, Khoo Yu Lin, Partner, Zaid Ibrahim & Co and Cheng Yen, Associate, Zaid Ibrahim & Co, highlight the Act’s key features, from its geographical scope and regulatory framework to the differing levels of oversight between carbon capture, transportation, utilization, and permanent storage.

Overview of the CCUS Act 2025 Regime

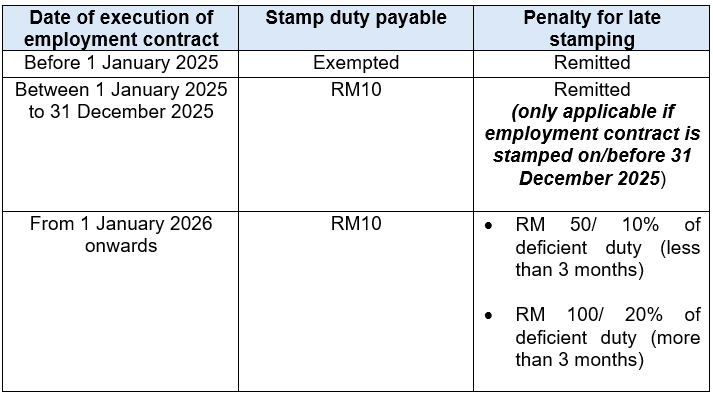

The Malaysian Inland Revenue Board (“IRB”) of Malaysia has recently picked up stricter enforcement on the Malaysian Stamp Duty Act 1949. In line with this, the IRB had initially commenced audit on various companies and required all employment contracts be subjected to stamping, and where applicable, late stamping penalty was imposed. Upon various lobbying efforts, the IRB issued an announcement to provide blanket remission on employment contracts, which can be summarized as follows:

Following this, a set of FAQs was issued by the IRB, [1] to provide further clarity on matters relating to imposition of stamp duty on employment contracts. Main takeaways are outlined below:

1. Who is responsible for paying stamp duty-employer or employee?

The person who signs the document first is responsible for paying stamp duty. Generally, it would be the employer.

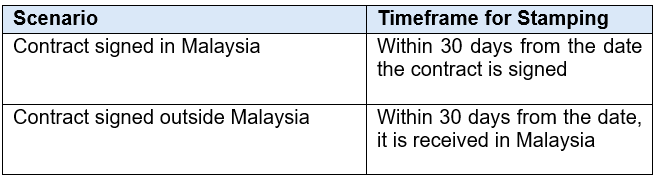

2. What is the timeframe for stamping an employment contract after it is signed?

An employment contract must be stamped within the following period:

3. Are temporary, short-term, part-time, or contract employment agreements required to be stamped?

Yes, all employment contracts have to be stamped.

4. Is stamping required each time an employment contract is renewed?

Yes, each new employment contract is treated as a separate instrument and must be stamped.

5. Is it necessary to submit employment contracts signed before 1 January 2025 to LHDNM for endorsement?

Employment contracts that have been granted an exemption may be submitted to IRB for assessment and endorsement in order to obtain a stamp duty exemption certificate.

6. Is there a fee for endorsing an exempted employment contract?

No fee is imposed unless the original stamp duty exceeds RM 10.

How Can We Help?

Considering the stricter enforcement of the Malaysian Stamp Act 1949 vis-a-vis increase in stamp duty audits and the impending stamp duty self-assessment system commencing 1 January 2026, our Tax & Duties team here at Zaid Ibrahim & Co. remains steadfast in assisting all taxpayers. Our legal assistance ranges from providing stamp duty trainings on the introduction and understanding the provisions of the Stamp Act and avoiding pitfalls, legal advice in applicable duties on instruments, to dispute work defending against stamp duty assessments be it by way of notice of objections or appeals to the Malaysian Courts.

[1] FAQ by Inland Revenue Board (3 July 2025) “Soalan Lazim 9FAQ) Penyeteman Kontrak Penggajian di Malaysia”

ZIC Tax Highlights: Stamp Duty on Employment Contracts

In a further step to liberalize the foreign exchange rules for Malaysian residents, Bank Negara Malaysia (“BNM”) has allowed Malaysian corporate investors with investment revenues denominated in foreign currency to apply to BNM for Qualified Resident Investor (“QRI”) status.

The QRI programme is open to Malaysian corporate investors that wish to repatriate foreign currency from overseas investments to Malaysia and convert the foreign currency to Malaysian Ringgit, and would like flexibility to redeploy those funds outside Malaysia as direct investments abroad (“DIA”). Foreign currency funds which qualify for the QRI programme are:

- income and proceeds from overseas investments (e.g. dividends, interest and sales proceeds); and

- existing foreign currency funds retained in an Investment Foreign Currency Account with banks in Malaysia.

Malaysian corporate investors may also apply for QRI status on a corporate group basis.

Upon successful registration with BNM, Malaysian corporate investors with QRI status will have flexibility under BNM's foreign exchange rules to reconvert their funds to foreign currency for their future DIA. No further BNM approval will be needed for such reconversion from Malaysian Ringgit to foreign currency and payments of those funds out of Malaysia.

Applications for QRI status are open from 1 July 2025 and extends to 30 June 2028. Malaysian companies wishing to register for the QRI status may submit an application to BNM through a form which is available here: https://www.bnm.gov.my/submission-of-application

BNM has provided helpful and detailed FAQs on the QRI programme here: https://www.bnm.gov.my/documents/20124/60360/QRI+FAQ_FINAL.pdf

Malaysian corporate investors with foreign investment income should take advantage of the QRI programme’s fast-tracked pre-approval framework for future re-investment abroad and register as a QRI. The QRI programme will ease such Malaysian investor’s foreign exchange compliance obligations going forward.

If you have any questions or require any additional information, please contact Loo Tatt King or the partner you usually deal with in Zaid Ibrahim & Co.

This alert is for general information only and is not a substitute for legal advice.

Bank Negara Malaysia Introduces Qualified Resident Investor Programme to Liberalize Foreign Exchange Rules for Malaysian Companies

As the global imperative for decarbonisation accelerates, carbon credits have become a strategic instrument for companies seeking to achieve their net-zero targets, manage residual emissions, or demonstrate voluntary climate leadership. In Malaysia, where the carbon market is evolving alongside global standards, purchasers of carbon credits—whether corporates, financial institutions, or intermediaries—must approach transactions with legal precision and strategic foresight.

This article examines the key legal considerations for prospective buyers of carbon credits, offering guidance on risk mitigation, contractual protections, due diligence, and alignment with ESG frameworks.

Understanding the Carbon Credit Ecosystem

Purchasers must first understand the fundamental attributes of the credits they intend to acquire. Carbon credits are generated through verified emission reduction or removal projects and certified by recognised standards such as Verra’s Verified Carbon Standard (VCS), the Gold Standard, or, the Climate Action Reserve (CAR) etc.

The type of project—whether it be forestry, renewable energy, or carbon capture—along with the credit’s vintage, additionality, permanence, and co-benefits, all influence its value. It is critical for buyers to assess whether these characteristics align with their environmental objectives, voluntary disclosures, or compliance requirements under frameworks such as the ISSB, SBTi, or the EU Carbon Border Adjustment Mechanism (CBAM).

Avenues for Purchasing Carbon Credits

In Malaysia, carbon credits can be procured through various channels, each offering distinct legal and commercial implications:

Understanding the method of procurement is critical for structuring the transaction, managing title transfer risk, and aligning with broader corporate ESG objectives.

Contracting Through ERPAs and Spot Market Agreements

Carbon credit transactions are commonly structured through Emission Reduction Purchase Agreements (ERPAs), which form the contractual backbone of credit procurement. Whether executed as spot purchases or forward contracts, ERPAs must be carefully negotiated to address key terms such as volume, price, delivery conditions, verification procedures, and risk allocation.

Buyers should ensure that ERPAs include robust representations and warranties on the authenticity, title, and non-encumbrance of credits, as well as remedies in the event of underperformance or credit invalidation. For pre-purchase or milestone-based agreements, clauses on credit replacement, delivery guarantees, and force majeure must be aligned with the crediting standard’s requirements and local legal enforceability.

Legal Due Diligence: Verifying Project and Registry Integrity

Although third-party verifiers play a critical role in certifying the environmental validity of carbon credits, comprehensive legal due diligence is essential to ensure that the credits being purchased are legitimate and aligned with the buyer’s objectives. This includes reviewing project documentation, land tenure rights, host country authorisations and/or stakeholder engagement records. See our article Carbon Credit Series - Key Legal Lessons from the Sabah Nature Conservation Agreement for case study on issues that arose from the Sabah Nature Conservation Agreement.

Equally important is the review of registry transactions. Purchasers must verify that the credits have not been previously retired, cancelled, or transferred and ensure that the registry account details are accurate. Legal due diligence safeguards the traceability and legal soundness of the credits being acquired, mitigating potential risks to the buyer.

ESG Reporting and Climate Claims Management

Purchasers intending to use carbon credits to support ESG disclosures or climate-related claims must ensure that such representations are legally defensible and aligned with prevailing standards. Misleading or unsubstantiated claims can expose companies to allegations of greenwashing, regulatory penalties, or investor backlash.

In Malaysia, this includes adherence to Bursa Malaysia’s Sustainability Reporting Guide and the National Sustainability Reporting Framework disclosure mandates. Legal oversight is also critical in structuring representations and disclaimers in public-facing documents to mitigate greenwashing risks and substantiate ESG claims.

Cross-Border and Tax Considerations

For Malaysian entities purchasing international credits, or foreign buyers acquiring Malaysian-origin credits, cross-border legal issues must be carefully navigated. These include jurisdictional enforcement, currency risks, and dispute resolution mechanisms.

Additionally, the tax treatment of carbon credits—whether treated as inventory, intangible assets, or financial instruments—can influence the structuring and reporting of such transactions. Buyers should obtain legal and tax advice to ensure compliance and optimise commercial outcomes.

Conclusion

Carbon credit transactions represent more than a commercial exchange—they are instruments of corporate climate strategy, reputational accountability, and stakeholder engagement. As such, legal oversight is essential to ensure that credit purchases are contractually sound, ESG-compliant, and aligned with global best practices.

-yellow.webp)